The Georgia Power Company 2023 Integrated Resource Plan (IRP) Update is problematic—built on flawed assumptions that lead to a predetermined outcome favoring corporate profits over the economics, the health & safety, and the public policy interest.

-

Georgia Power Company's Forecasted Peak Demand versus Actual Peak Demand

Georgia Power Company claims in this 2023 IRP Update that load growth is “unprecedented.”

Compare this claim to the load growth they claimed in the 2007 IRP, the 2010 IRP, and the 2013 IRP—each of these IRPs forecasted much higher load through 2030 than this so-called “unprecedented” load growth today. The Budget 2007 Total Peak forecast was a key assumption used by Georgia Power Company to imprudently justify Vogtle 3&4, but was clearly wrong and reflects on Georgia Power Company’s poor track record on forecasting.

A key pillar of Georgia Power Company’s load growth outlook was the $5 Billion Rivian electric vehicle manufacturing plant just east of Atlanta. Rivian announced in March 2024 that it would pause its plans to move forward with the factory.

-

Historical Average Electricity Rates by Customer Class

Residential rates have risen 68% since the 2007 IRP when GPC sought authorization for Vogtle 3&4. Industrial rates only rose 28% in that time. Inflation rose 49% in that time. It is clear that Residential Ratepayers are absorbing the lion’s share of rate increases. A primary reason for this is the lack of a Utility Consumers Counsel as well as active lack of regulation of Integrated Resource Planning and subsequent Rate Cases dating to the 2007 IRP.

The upshot is that Residential Ratepayers have been hosed at the expense of industrial and commercial ratepayers. This is 100% directly attributable to the 100% defunding of the Consumer Utility Counsel and the lack of representation before the Commission.

The massive inflation we’ve seen in the past several years has been due imprudent IRPs put forward by Georgia Power Company with the express intent to maximize corporate profits at the expense of all ratepayers but especially Residential Customers.

The Self-Serving "Fossil Fuel Bonanza" in the Georgia Power Company 2023 Integrated Resource Plan Update

The Self-Serving "Fossil Fuel Bonanza" in the Georgia Power Company 2023 Integrated Resource Plan Update

Army Excoriates Georgia Power Company On Their Failed 2023 Integrated Resource Plan Update

Army Excoriates Georgia Power Company On Their Failed 2023 Integrated Resource Plan Update

Consumer Utility Counsel - Hardworking Georgians Need an Advocate Who Gives a Damn, Unlike the Georgia Power Company Service Commission

Consumer Utility Counsel - Hardworking Georgians Need an Advocate Who Gives a Damn, Unlike the Georgia Power Company Service Commission

How is the 2023 IRP Update flawed?

-

Georgia Power Company already uses the poorly outdated Aurora model for its IRP, then adds its own disinformation to arrive at a pre-determined outcome. A list of GPC IRP flaws includes, but is not limited to:

(1) the long-term capacity expansion plan modeled in Aurora was constrained to only allow for generic capacity expansion beginning in the year of capacity need, which in the 2022 IRP was 2029. Yet in 2024, GPC announces the year of capacity need is 2025, but that is not reflected in the published Avoided Cost.

(2) The Company failed to address the issue of uneconomic dispatch commitment examined by Synapse in their November 2021 report “Georgia Power’s Uneconomic Coal Practices Cost Customers Millions.” Synapse determined that the Company’s uneconomic unit commitment practices resulted in $232 million in excess costs for Customers from 2017 to 2020. As in past IRPs, this coal and gas-heavy proposed portfolio fails to adequately demonstrate the economic benefits to Georgia and to Customers as required by O.C.G.A. § 46-3A-2.

(3) Continued over-reliance on a non-diverse, gas-heavy portfolio. The Company’s own scenario modeling shows that there is significant upside risk that Total System Costs could be much higher than the Base Case. This creates upward rate pressure risk from any level of carbon pricing and from high gas prices. The Base Case is six (6) times riskier than a low gas future if each scenario is equally likely as the Company claims. This is not an acceptable risk when existing, commercial technologies like solar+storage can provide all the energy, capacity, and ancillary services that gas fired units can provide, except at lower cost and lower risk than gas.

(4) Georgia Power Company assigns a 0% capacity accreditation to solar in the winter, which is incorrect. It also assigns a 100% capacity accreditation to gas and coal thermal plants, which is also very incorrect. This biases the model toward fossil thermal generation.

(5) The System reserve margin is too high because the generation capacity of Georgia Power Company and Affiliates is overbuilt, beyond what is recommended in the company’s economic Target Reserve Margin. Furthermore, there are significant historical energy exports to neighboring Balancing Authorities, which is a strong signal of excess capacity, uneconomic unit commitment, or both. Overbuilt capacity is a significant cost that is not in the interests of Georgia and Customers of the Company.

(6) Transmission planning is conducted independently of the generation planning and is only planned out 10 years, half the time horizon as generation planning. Generation and transmission planning analysis can be performed together, which provides internal consistency to the modeling and increased confidence in results, after which more detailed transmission analysis (voltage, frequency, thermal violations, etc.) can be conducted.

-

This IRP assumes carbon capture and sequestration (CCS) will not only be commercially viable but up to 8,000 MWs could be installed and operating on Georgia Power Company’s system by 2034, just 10 years from now. This assumption is not grounded in reality but rather in disinformation from an affiliate of Georgia Power Company, the National Carbon Capture Center, meant to make it seem like carbon capture is a viable technology. But from the Company’s own testimony, “Although these technologies are not demonstrated nor technically feasible for implementation on simple cycle combustion turbines, the Company nonetheless included an assessment of possible costs.” The Company then says that, “carbon capture costs are unreasonable for Plant Yates Units 8-10,” leaving this power plant exposed to emissions compliance costs and at high risk of becoming stranded assets, which Georgia Power Company will ask to be put into the rate base as a regulatory asset, yet another hidden cost of gas.

-

This IRP fails to account for the cost today to use fossil gas as a fuel, by assuming $0 for CO2-equivalent emissions in the MG0 case (used as the base case). The reality is there is a methane emissions charge in place in 2024 that adds $900 per ton of methane, growing to $1,500 per ton by 2026. Georgia Power Company’s plan to meet load growth is based on a world in which greenhouse gas emissions cost $0, which does not reflect the reality today. The result is a flawed and rushed 2023 IRP Update.

-

Georgia Power Company is inflating the size of the load growth by assuming a statistically improbable level of load growth, at the 95th percentile instead of the 50th percentile. This inflates the magnitude of the capacity need and makes it appear as if the need is much larger than it is likely to be. Many of these prospective customers and their load growth are not even located in Georgia Power Company’s service territory or they are controversial cryptocurrency mining operations. The Company was unable to forecast 2 years into the future, from its 2022 IRP to this one, with a load forecast that was off by 1650%, so how can we trust their plan to take us 20 years into the future?

A key pillar of load growth outlook was the $5 Billion Rivian electric vehicle manufacturing plant just east of Atlanta. Rivian announced in March 2024 that it would pause its plans to move forward with the factory.

-

Just a few IRP cycles ago in 2016, Georgia Power Company said, “Adding only natural gas-fired resources would result in an over-reliance on a fuel with a history of volatility and which is subject to potential future cost increases driven by regulation, changing market conditions and other factors.” Meanwhile they locked in nearly 2,400 MWs of gas-fired capacity in 2022 and now they want 2,300 more MWs of gas in this IRP. At the same time, Georgia Power Company has scaled back their fuel price hedging program in its Fuel Cost Recovery FCR-26 docket because Georgia Power Company passes 100% of the cost of fuel onto ratepayers. They can be cavalier about gas prices in their modeling because they bear no risk. In 2023, Georgia Power Company came before the Georgia Public Service Commission to recover an extra $2 billion in fuel costs for fossil gas on top of their normal annual gas bill of $2 billion. Meanwhile, solar and wind are continuing their record-long streak of $0 fuel costs. By contrast, with gas, there are hundreds of millions of dollars, likely billions of dollars in hidden costs to gas-fired power plants that Georgia Power Company cleverly manipulates to be excluded or minimized in its IRP analysis.

-

The IRA is heavily undervalued in this 2023 IRP Update. Georgia Power Company is undercounting the IRA benefits, using a small tax credit bonus for generic renewables or BESS additions when 40% or 50% is expected for utility scale solar and storage projects. It is possible for distribution level solar and storage projects to achieve even higher percentages of a project’s cost in Investment Tax Credit and other federal benefits provided by the IRA. Moreover, Georgia Power Company is suppressing the development of new solar and storage resources by not committing to a retirement date of 2028 for its coal units, which would unlock the 10% Energy Community tax credit and new economic development at critical sites like near Plant Bowen and near Plant Scherer. We are 1.5 years into the IRA with 8.5 years left, and Georgia Power Company is wasting this opportunity.

-

The Mississippi Power Company Power Purchase Agreement for 750 MW is a black box that when opened is full of dirty coal, gas, and likely the worst of their power plants, the bottom of the barrel. Georgia Power Company has not revealed what is in the PPA but we can expect it contains coal-fired and gas-fired capacity dating to 1965, meaning the oldest assets will be entering their 7th decade of service.

Georgia Power Company appears to have entered into this PPA and the Santa Rosa PPA outside of the law, specifically O.C.G.A § 46-3A-3 that lists “Actions prohibited without a certificate of public convenience and necessity” and this includes “enter[ing] into a long-term purchase of electric power” and would infer prohibition of the further step of re-marketing a contracted PPA for two (2) years prior to capacity need.

-

Georgia Power Company has already spent $250 million on the Yates CTs without any approval from the Commission. They already signed a precedent agreement for gas pipeline service possibly from its own pipeline affiliate and also contracted for engineering services with a major EPC contractor and also began procurement with a major turbine OEM, already signed and in effect as of last month, and also signed a Payment for Ecosystem Services agreement for the Yates CTs, and initiated LGIP applications for interconnection request for the Yates CTs and even held the interconnection request scoping meeting for Yates CTs back in August 2023. All these actions and costs were made imprudently before allowing the Commission to review and approve them. This is why there is breathless urgency from Georgia Power Company to make haste and approve this massive buildout of new gas-fired units…or at least get their imprudent costs covered as regulatory assets. This is a waste of $250 million in sunk costs for which Georgia Power Company is already asking pre-emptively to be given regulatory asset treatment.

Moreover, the Yates CTs will not be able to deliver full firm Network Resource Interconnection Service or NRIS transmission capacity to meet peak loads until 2028—many years after the current capacity shortage. The Company only requested Energy Resource Integration Service or ERIS in the interconnection queue for the Yates CTs, which means the CTs can be curtailed during peak demand and cannot provide full deliverability to the network during periods of stress (until 2028).

What are the practical and low-cost solutions to help meet electric load growth in Georgia?

-

A program like Hawaii Electric Company (HECO) and their highly successful Battery Bonus program should be the model in Georgia. Battery Bonus is simple: the utility pays an upfront cash incentive to help pay for the install (before counting the 30% tax credits) and provide bill credits for customers to add energy storage to a new or existing rooftop solar system. All customers receive an $850/kW payment for the battery plus an ongoing fee for usage, in exchange for a 10-year commitment of capacity that is discharged from the battery for 2 hours during the evening peak. The popular Battery Bonus incentive in Hawaii quickly reached the cap of 3% of total system firm capacity, demonstrating a rapid and proven solution to the acute near-term capacity shortage.

-

Grid-Enhancing Technologies are technologies that are commercially available today, are low cost, and increase power grid transmission capacity by 30% or more to directly enable the existing grid to accommodate more renewable energy projects. Examples include Ambient Adjusted Rating devices that measure the power lines temperature, current, and angle in real-time.

The Danish Transmission System Operator and other NorIic TSOs have seen great success using GETs. It allows transmission system operators to implement hourly ratings that change based on the projected ambient temperature every hour instead of just summer and winter ratings and comply with FERC Order 881 as Georgia Power Company is required to do by 2025. While this docket is focused on supply side resources with a passing glance toward demand side management, there is a direct impact on the cost of the Transmission Planning Study (Docket #25981). In its response to STF-GS-1-7 “Has the Company evaluated whether the transmission upgrades identified in the Transmission Screening Analysis could be reduced, deferred, or eliminated with the deployment of grid-enhancing technologies including dynamic line ratings, topology optimization, power flow control devices, and similar solutions?”

GPC did not file an update to its transmission planning study in Docket #44160 as of the intervenor testimony filing deadline, but they did respond, “Due to the timing of the transmission constraints, the most appropriate projects were developed.” Note that the PIA staff and intervenors asked if grid-enhancing technologies had been considered in the last IRP, and GPC demurred then as well as now. When asked if GPC is considering grid-enhancing technologies, the answer was no, they are considering reconductoring, redispatch, and rebuild but not dynamic line ratings and other grid-enhancing technologies.” GPC will not pursue this low cost, commercially available suite of technology solutions known as grid-enhancing technologies that can help to solve the near-term capacity and energy shortfall unless the Commission requires it in this proceeding.

-

In Document Filing #216375 in Docket #44160, GPC gives its 2023 Q3 figures for Community Solar, which look pitifully small if accurate. GPC reports 0.04% of its residential customers are participating in the Community Solar offering. Clearly, this failure is on GPC’s program design, whereas by contrast we have multiple examples of successful Community Solar programs flourishing across the United States.

-

Georgia Power Company has a long history of anti-competitive behavior. In particular, GPC intentionally makes it difficult to develop cheap, clean, firm new generation resources in Georgia by obscuring and changing the calculation of system Avoided Cost, which is the cost GPC avoids by not producing for itself an equivalent amount of energy and capacity. PURPA requires electric utilities to purchase the electric energy and capacity made available by these generators at just and reasonable rates. However, independent power producers have had difficulty selling energy and capacity to GPC, whether as a PURPA qualifying facility or when trying to secure a Power Purchase Agreement.

In January 2024, a major developer of renewable capacity and energy resources filed a petition before the Commission in Docket #4822 that states, “At a time when Georgia Power acknowledges its urgent need for new generation capacity, [this developer] urges the Commission to remove unlawful barriers blocking the development of 420 MW of new, clean, affordable power generation that [this developer] stands ready to build and operate.” This developer has significant solar and storage capacity it could bring online to help meet the acute short-term capacity shortage, but for GPC standing in the way.

In the 2022 IRP and again in the 2023 IRP Update, the Incremental Capacity Equivalent (ICE) Factor showed utility scale solar with a 10% winter and 35% summer capacity value (rooftop solar is 5% and 25%, respectively). Solar has non-zero capacity value at all times, yet solar received a 0% capacity credit in the GPC capacity RFP.

-

In response to STF-PIA-3-5, Georgia Power Company acknowledges that the Thermostat DR program shows a positive Total Resource Cost based on kW demand savings, and this despite lower Avoided Costs that hurt Demand Side Management measures. The Company is artificially limiting this program to 25,000 customers or well under 1% of residential customers, when it could expand the program to 2.3 million residential customers. This is a missed opportunity and an example of a concrete action this Commission can authorize to address the acute near-term capacity shortage.

-

In its response to STF-JKA-6-5, Georgia Power Company states, “Yes, the Company could consider an agreement outside of a RFP process for the potential new or planned projects.” The Commission should require the Company to add MWs to the current RFP and entertain proposals received outside of announced RFPs and RFIs, which would be subject the same rigorous scrutiny for interconnection and other requirements without being burdened by Georgia Power Company’s onerous, time-intensive, and inefficient RFP and RFI solicitation process.

-

The Intercompany Interchange Contract (IIC) provides for coordinated planning between the Operating Companies and for the sharing of surpluses and deficits of capacity. Georgia Power Company could rely on the reserve sharing provision of the IIC, utilizing its affiliates’ capacity surplus in Winter of 2026 to eliminate the GPC capacity deficit. See Hearing Request 1-3 for more context. Beginning in Winter of 2027, GPC notes that its need with planning reserve sharing would be slightly less due to another affiliate having a small amount of capacity surplus for Winter of 2027 through Winter of 2040. This capacity is available to Georgia Power customers.

-

Georgia Power Company did not discuss in its 2023 IRP Update main document or direct testimony that Plant Franklin is an existing resource that has 712+ MW of winter capacity resources in the short-term capacity need years, which did not participate in the GPC 2022-2028 Capacity RFP and which is owned by GPC’s affiliate Alabama Power Company. This existing gas resource was not considered, leading in part to the selection of new gas builds at Plant Yates.

Moreover, the completely arbitrary 70/30 rule that says if Georgia Power Company doesn’t own 70% or more of the generating assets than the system will be unreliable is patently false. Any claim that PPAs are less reliable than GPC-owned assets is much less of a concern than meeting load growth with available assets. GPC argues without merit that PPAs should be limited to 30% of load because PPAs are more risky. However, many other utilities like Detroit Edison (DTE) in Michigan have PPA ownership at 50% and see no reliability concerns. Also, many PPAs are with GPC affiliates, raising concerns more about reliability with GPC affiliates and less about the contract structure of a PPA that can be rewritten to fully mitigate any perceived risk.

-

Georgia Power Company can trigger an additional 10% investment tax credit by retiring coal plants and siting new solar and storage facilities in the resulting Energy Communities. By keeping these coal plants running when they are currently uneconomic and not retiring them, they are putting significant upward pressure on electricity rates. Specifically, retiring Plant Bowen and Plant Scherer would open up significant new economic development in solar and battery storage project development in those economic catchment areas.

Georgia Power Company 2023 IRP Update Rebuttal Testimony (source: https://psc.ga.gov/search/facts-document/?documentId=218033) is an example of the manipulation the Company performs in this IRP and all past IRPs, in order to twist how it presents the Plant Yates CTs and other fossil assets.

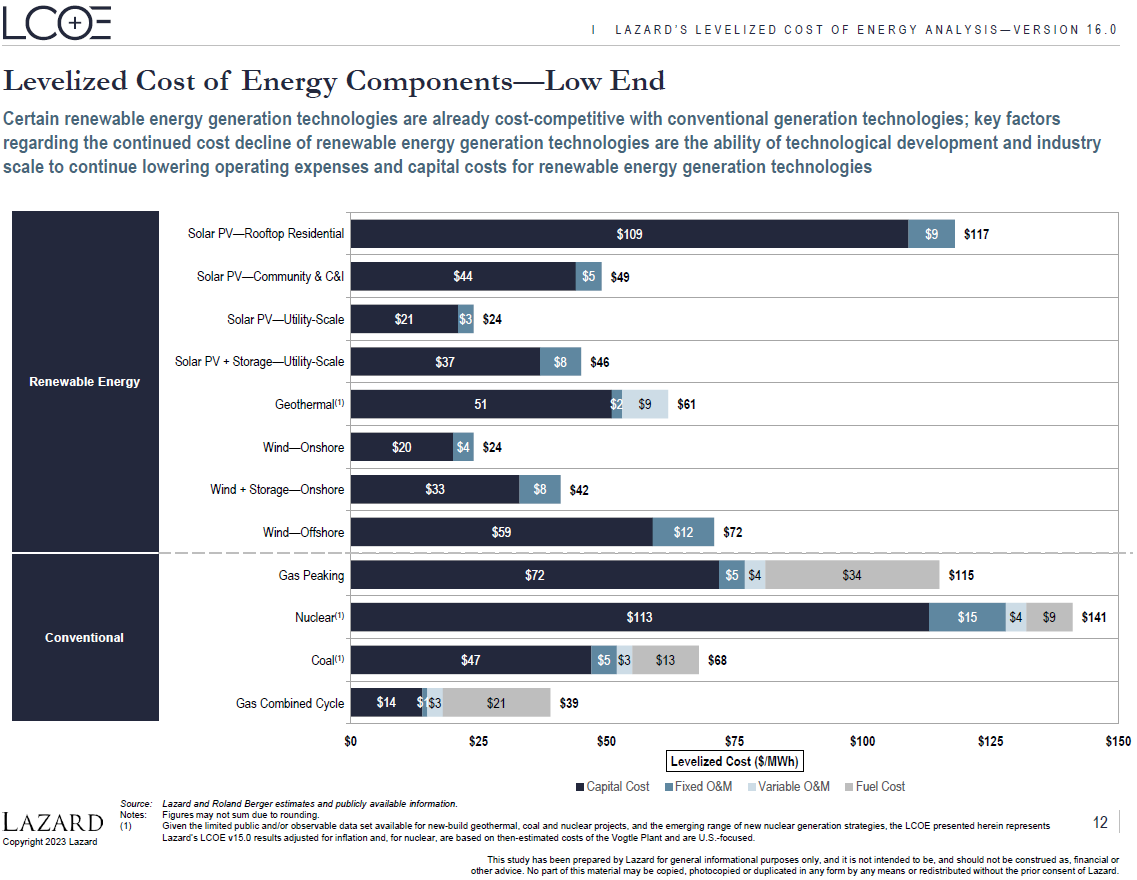

In the Rebuttal Testimony (Exhibit 3), Georgia Power Company points toward the low cost of gas peaking technology. We see in this “Capital Cost Comparison” that Utility-Scale Solar PV is $700/kilowatt and for Gas Peaking it is the same $700/kW. We also see that for Utility-Scale Solar PV + Storage it is $1,075/kilowatt. What Georgia Power Company does not bring to your attention is this is a Capital Cost Comparison, which does not compare fuel costs or operating costs or maintenance costs or any other lifetime costs that do not appear in this graph, which is why Georgia Power Company selected this graph only from the LCOE study.

This is a fundamental misapplication of an LCOE comparison, which is meant to capture capacity and energy costs and indeed “costs levelized over the operating life.” This can be seen in the very next graphs in this report that Georgia Power Company cites. To be clear, Georgia Power Company specifically used this LCOE graph because it is capital costs only and ignores the greater total levelized costs of gas peaker energy.

In these subsequent graphs, the 2023 Lazard studies shows that Utility-Scale Solar PV costs on a $ per MWh basis are between $24 and $96/MWh, and for Utility-Scale Solar PV + Storage costs are between $46 and $102/MWh. Meanwhile gas peakers are between $115 and $221/MWh.

Conclusion: The Plant Yates CTs are immediately more expensive than utility-scale solar PV + storage.

This is a clear demonstration by Georgia Power Company of the manipulation of data to conform to the Company's desired outcome of selling natural gas to benefit its many affiliate companies whose profits flow to the same corporate parent as Georgia Power Company and to lock in decades of natural gas sales. The Plant Yates CTs would operate into the 2070s.

Source: https://www.lazard.com/media/2ozoovyg/lazards-lcoeplus-april-2023.pdf